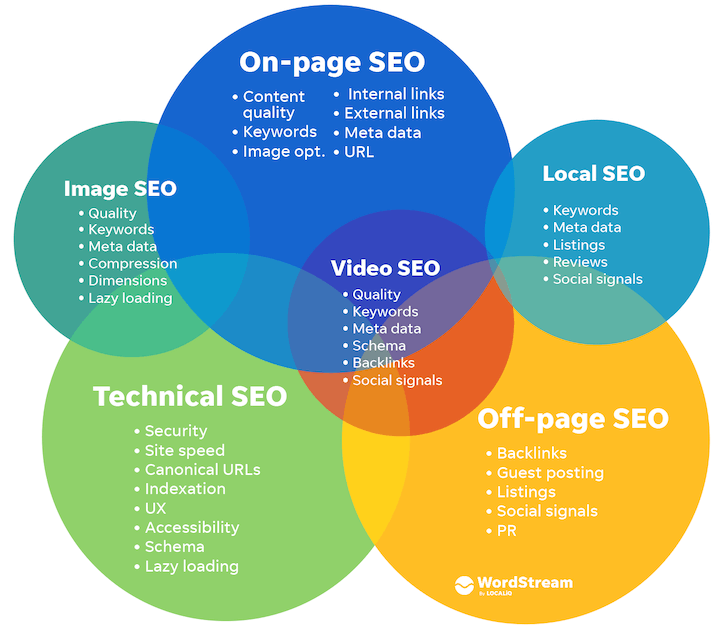

سئو در سایت چیست

یک سئو بسازید که هر کسی به آن افتخار کند اگر از وردپرس برای طراحی وبسایت خود بهره گرفتهاید باید بدانید هسته اصلی وردپرس به طور کامل بر اساس اصول اولیه سئو طراحی شده است. اینجا قراره به یه سری چک لیست توی سئو داخلی وب سایت اشاره کنیم که میتونید توی هر مدل سایتی … ادامه